Cryptocurrency CollateralisedLending

Technical and procedural assurance for crypto-backed commercial loans, with core focus on stablecoin-secured transactions

Validate Collateral

Comprehensive digital asset validation and integrity assessment

Ensure Compliance

Regulatory risk assessment and cross-border compliance review

Mitigate Risk

Operational risk mitigation throughout loan lifecycle

Important: We do not offer legal or financial advice, but work closely with professionals who do. Our role is delivering technical and procedural assurance for confident decision-making.

Who We Support

Our expertise serves a diverse range of participants in the crypto-collateralised lending ecosystem

Private Lenders & Credit Funds

Supporting private lenders and credit funds seeking crypto-secured opportunities with comprehensive risk assessment and validation services.

Brokers

Facilitating digital asset-backed transactions with technical validation and procedural assurance for smooth deal execution.

Custodians & OTC Desks

Managing wallet infrastructure with comprehensive security assessments and operational risk mitigation strategies.

Institutional Borrowers

Supporting institutional borrowers pledging crypto as security with collateral validation and compliance assurance.

Professional Service Firms

Providing technical validation services to support client reviews and due diligence processes for professional service providers.

What YouReceive

Comprehensive documentation and analysis to support confident lending decisions

Digital Asset Validation Reports

Comprehensive technical analysis of proposed collateral

Risk Summaries

Counterparty and transactional risk assessments

Forensic Screening

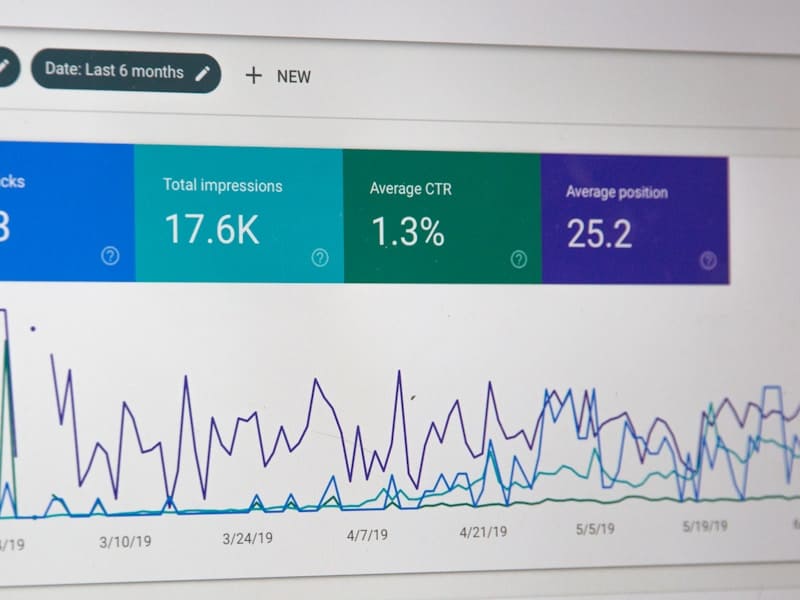

Blockchain forensic screening outcomes and analysis

Traceability Assessments

Complete collateral traceability and provenance analysis

Dispute Preparedness

Comprehensive checklists for potential disputes

Governance Documentation

Procedural documentation aligned with best practices

Services Include

Comprehensive support throughout the entire crypto-collateralised lending process

Digital Asset Collateral Validation

We independently assess the integrity, provenance, and control of proposed digital collateral including verification of wallet ownership, blockchain-based validation of pledged balances, identification of exposure to sanctioned addresses, and support with escrow and custody arrangements.

Transaction Structuring & Execution Readiness

We assist in shaping transactions that are operationally viable and institution-grade, reviewing loan mechanics, identifying gaps in collateral coverage, and assessing wallet structure compatibility with lenders' internal risk tolerances.

Regulatory Risk & Cross-Border Compliance

We raise issues that may require further review from legal or compliance professionals, including foreign exchange restrictions, AML/CTF risk exposure, asset classification implications, and recommended disclosures aligned with global standards.

Borrower & Deal Participant Profiling

We support pre-transaction risk assessments by profiling all counterparties, including organizational structure analysis, UBO identification, financial position review, and mapping of third-party intermediaries and payment flows.

Documentation Support & Governance Alignment

We assist lenders and brokers in aligning supporting materials with best practices, coordinating technical documentation, reviewing escrow mechanics, and integrating blockchain forensic results into compliance files.

Ready to Enhance Compliance?

Partner with LY Forensics for compliance and risk assessment services on cryptocurrency backed lending.